650 x 103

Modeled Results

600

Linear

550

Fit

Eq. 5

500

450

400

20 x 10 3

13

14

15

16

17

18

19

Cargo Ship Rate ($/day)

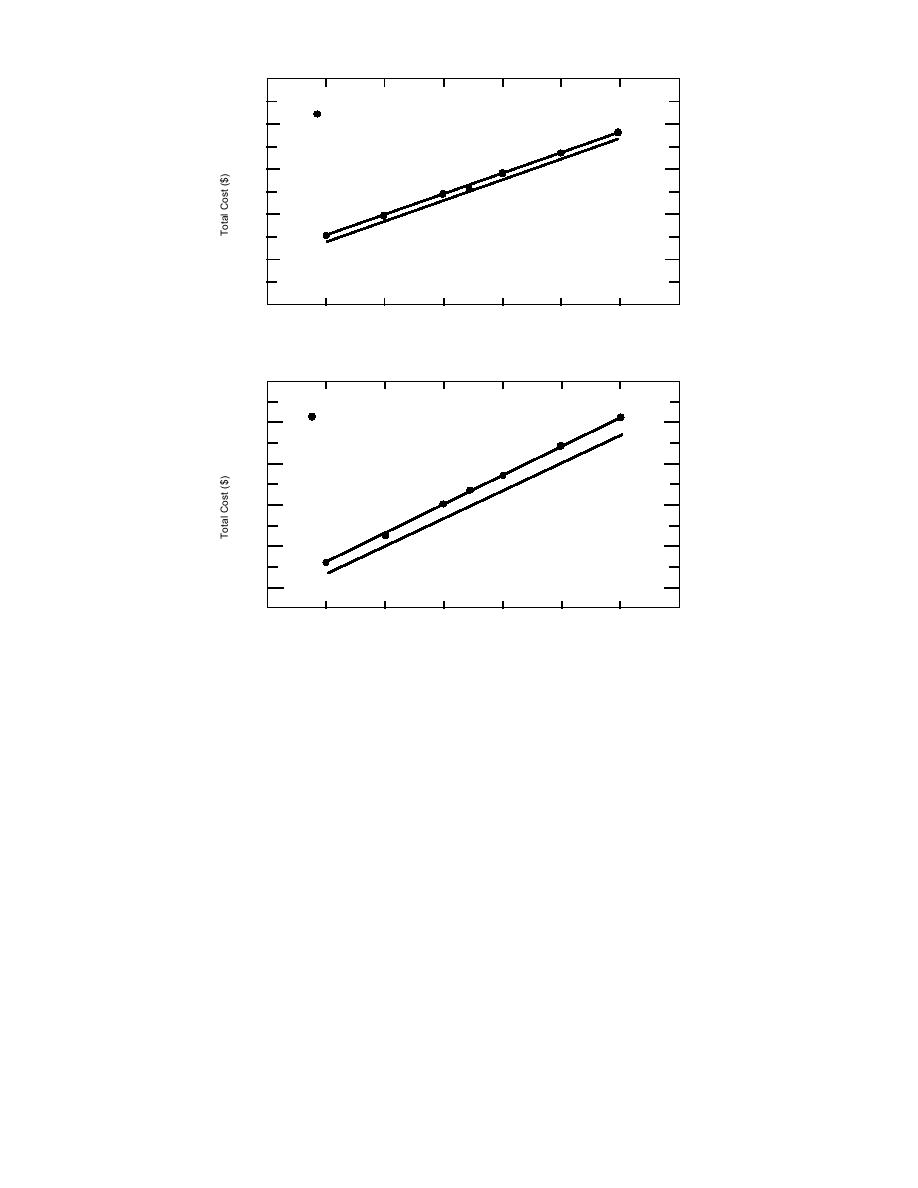

a. April transits.

400 x 103

Modeled Results

380

360

Linear

Fit

Eq. 5

340

320

300

20 x 10 3

17

18

19

13

14

15

16

Cargo Ship Rate ($/day)

b. August transits.

Figure 13. The effect of cargo ship rates on total shipping costs.

D show that the simple equation insignificantly

For this scenario, eq 5 then becomes:

underpredicts the numerical model.

TCApr = (,450 23.588 days) + (IBR 22 days)

For August transits, the linear fit to the numeri-

cally modeled results is

and

TCAug = 3.310 IBR + 3,166

TCAug = (,450 13.601 days) + (IBR 4 days),

and the corresponding r2 statistic is 0.9775. The

and the results of varying IBR are presented in

change in total cost is 3.31 times the change in the

Table 18 and Figure 14. The least-squares linear fit

icebreaker rate. The difference between the simple

to the modeled results for April was

prediction equation and the numerical result is

similar in magnitude to the April differences.

TCApr = 21.810 IBR + 6,808

Finally, MF was varied while holding CSR and

IBR constant. CSR was held at ,450/day while

with an r2 statistic of 0.9995. The slope shows that

IBR was held at zero. For this scenario, eq 5 then

becomes

for every

||content||

change in the icebreaker 's daily rate,

there is a resulting .81 change in the total cost

TCApr = (,450 23.588 days) + MF

of transit. Again, the difference values in column

39

Previous Page

Previous Page